Blogs

Help make your basic estimated taxation payment by the due date to have submitting the prior year’s Mode 1040-NR. When you yourself have earnings subject to the same withholding regulations you to definitely apply at U.S. people, you should file Form 1040-NR and then make your first estimated income tax commission because of the April 15, 2025. If you don’t has wages susceptible to withholding, document your revenue taxation go back and then make the first projected taxation commission by Summer 16, 2025. For those who document an application W-4 to minimize or take away the withholding on your own grant otherwise grant, you must document an annual U.S. income tax come back to getting welcome any write-offs your advertised to your one to function. When you are in america through the more than step one taxation season, you must install an announcement to the yearly Setting W-cuatro showing you have registered a great You.S. tax return to your past seasons. When you have perhaps not experienced the usa for a lengthy period to be expected to document an income, you ought to install a statement to the Function W-cuatro stating you’ll document an excellent U.S. tax go back when expected.

Line 6 – Will be Claimed since the Dependent

For additional info on lead put out of adjusted refunds, check out ftb.ca.gov and search to possess lead put. Go into the part of their refund you would like personally transferred to your per membership. When submitting a distinctive come back, the entire of line 116 and range 117 need equal the new complete quantity of your refund on line 115.

Nebraska Leasing Direction Software

You will need to provide considerably more details than simply you’ll for a good normal savings account, even though. Very borrowing unions requires you to discover a portion deals account for the credit union as an element of are a part. These types of membership are often rather earliest — they have been unlikely to be high-give deals profile, such as — and you may should keep a little bit of profit her or him so you can remain in an excellent position to the bank. If you would like a card partnership more than a bank, Pentagon Government Borrowing from the bank Partnership is a good options.

Applying of Costs

With nearly a few grand fastened in the in initial deposit on the lease identity is a lot of money. The lease legitimately talks of exactly what portion of your own put may be owed back after going out just in case it needs as paid to you. When you’re state and you can local legislation are different, very should expect their put back within thirty days away from swinging aside, as well as a keen itemized directory of deductions. Inside the Pennsylvania, just after five years in the a rental, the protection deposit can also be’t getting enhanced even when the rent increases, however in Ny it will. Or, if you want to read the regulations for your self, talk about the condition-by-county overview of defense deposit laws.

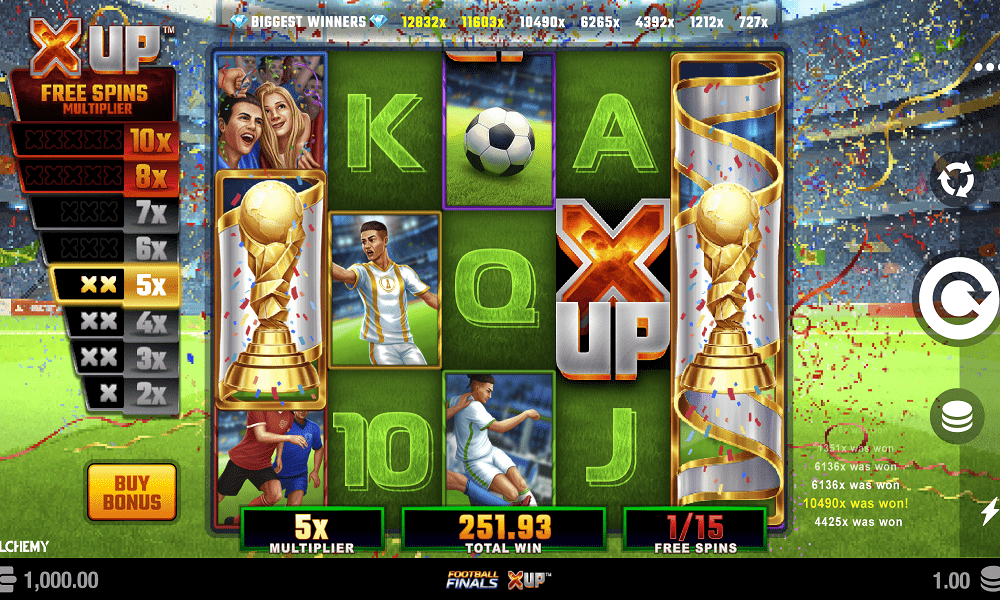

As a result of the ascending popularity and you can prevalence from Buy Now Shell out After (BNPL) features, the brand new emerging tenant casino wheres the gold foot wants fee independence. There are lots of systems and you will software available to choose from which help your residents do that efficiently various other elements of their lifetime, it is reasonable to provide roommates the choice to accomplish a comparable with the shelter deposit. And an interest in deeper transparency along the way from the day they circulate they on the months after they get out, citizens mutual tastes regarding the commission by itself. Roost powers put operations for local profiles and you can NMHC-rated operators the exact same—streamlining workflows, ensuring conformity, and you may to make residents happy which have quicker, more clear refunds. Here’s a listing of relief software to have renters feeling hardship.

Can there be a requirement that property owner spend myself the eye accrued to my put money?

The following Internal revenue service YouTube streams provide small, informative videos to your individuals income tax-relevant topics in the English, Foreign language, and you may ASL. For individuals who must rating a cruising otherwise deviation permit and you also don’t be considered so you can document Setting 2063, you must file Function 1040-C. If you are partnered and you will inhabit a residential district property state, along with provide the above mentioned-indexed files for the partner. Getting the sailing otherwise departure permit is certainly going reduced for many who give the newest TAC work environment data files and you will files linked to the income along with your remain in the united states. The new declaration should be presented to a keen Internal revenue service Taxpayer Guidance Cardio (TAC) place of work. Common law legislation affect determine whether you’re a worker or an independent builder.

To learn more in regards to the standards lower than a certain income tax treaty, down load the whole text message of all of the You.S. income tax treaties in the Internal revenue service.gov/Businesses/International-Businesses/United-States-Income-Tax-Treaties-A-to-Z. Technical causes for most of those treaties can also be found from the you to site. Below these types of arrangements, twin publicity and you may twin benefits (taxes) for the same work is got rid of. The newest arrangements generally make certain that societal protection fees (and mind-a job income tax) are paid off only to one country. The brand new USCIS it allows for the-campus benefit pupils in the “F-1” status if it doesn’t displace a U.S. resident. On-campus work boasts performs performed in the an off-university venue which is educationally affiliated with the school.

Ivan may be able to introduce a closer link with Russia to own that point January 6–ten, 2024. To possess determining if or not you’ve got a deeper connection to a different country, the taxation family must also get into life for your newest year and really should be located in the same foreign country that you’re saying to own a better partnership. For individuals who qualify in order to exclude days of exposure because the a professional runner, you must document a totally done Mode 8843 to the Internal revenue service.

A whole and you may exact revelation from an income tax status to your compatible 12 months’s Agenda UTP (Form 1120), Unsure Income tax Position Report, might possibly be treated since if this provider registered a form 8275 otherwise Mode 8275-Roentgen regarding your income tax condition. The newest processing of a form 8275 otherwise Setting 8275-R, however, won’t be handled since if the corporation filed a routine UTP (Setting 1120). If the an alerts out of purpose to help you levy is actually granted, the interest rate will increase to 1% in the very beginning of the very first week beginning at least 10 months after the go out that the see is given. If the an alerts and need for instantaneous payment try awarded, the interest rate increase to a single% in the beginning of the first few days birth after the day that observe and you will demand try awarded. If you find alterations in your income, write-offs, or loans after you post your own get back, document Mode 1040-X.

You need to use Baselane’s property owner bank-account to make virtual sub-accounts to help you put personal protection deposits for every assets. Defense deposits are usually obtained following book try finalized and you can before renter moves inside otherwise requires palms of your own leasing. If the an occupant don’t pay the security put in full, the new landlord or home government team can also be terminate the new book and you will book to some other potential occupant that was thoroughly screened. Within the a properly-known analysis, it actually was unearthed that 40 percent away from Americans couldn’t been with the bucks finance to cope with a $400 disaster bills.